Xush kelibsiz, kelajakdagi raqamli qidiruvchi! Bitcoin va Ethereum kabi yaltiroq kriptovalyutalar qanday paydo bo'lishi haqida hech o'ylab ko'rganmisiz? Bu sehr emas, balki "mayning" – qisman texnologiya, qisman iqtisodiyot va markazlashmagan kripto dunyosi uchun butunlay muhim bo'lgan jozibali jarayon. Agar siz 2025 yilda ushbu qiziqarli sohada qatnashmoqchi bo'lsangiz, siz to'g'ri joyga keldingiz. Ushbu keng qamrovli, yangi boshlanuvchilar uchun qulay qo'llanma kriptovalyuta mayningi sirlarini ochadi, bu sizga o'zingizning raqamli oltin shoshqinligini boshlash uchun mustahkam poydevor beradi. Shunday qilib, virtual kirkangizni oling va qazishni boshlaylik!

Kriptovalyuta Mayningi Aynan Nima? 🤔

Mohiyatan, kriptovalyuta mayningi – bu yangi kriptovalyuta birliklari yaratiladigan, shuningdek, tranzaksiyalar tekshirilib, blokcheynga (blockchain) qo'shiladigan jarayondir. Blokcheynni ulkan, ommaviy, o'zgarmas raqamli buxgalteriya kitobi sifatida tasavvur qiling. Har safar kimdir boshqa odamga kripto yuborganida, bu tranzaksiya yozib olinishi va tasdiqlanishi kerak. Aynan shu yerda maynerlar ishga kirishadi!

Maynerlar murakkab hisoblash jumboqlarini yechish uchun kuchli kompyuterlardan foydalanadilar. Jumboqni birinchi bo'lib yechgan mayner blokcheynga tasdiqlangan tranzaksiyalarning yangi "blokini" qo'shish huquqini oladi va mukofot sifatida yangi yaratilgan kriptovalyuta va ko'pincha tranzaksiya to'lovlarini oladi. Bu boshqa maynerlarga qarshi poyga, o'sha qimmatbaho mukofotlar uchun raqamli bellashuvdir.

Ushbu jarayon ikkita muhim vazifani bajaradi:

- Yangi Valyuta Yaratish: Bu yangi tangalarning muomalaga kirib kelish usuli (masalan, yangi Bitkoinlar “mayning” qilinadi).

- Tranzaksiyani Tasdiqlash; Tarmoq Xavfsizligi: U tranzaksiyalarni tasdiqlaydi, ikki marta sarflashning oldini oladi va butun markazlashmagan tarmoqni firibgarlik va hujumlardan himoya qiladi. Maynerlarsiz blokcheyn ishlamaydi!

Mayning Evolyutsiyasi: CPU'lardan ASIC'larga (va Undan Keyin!) 🚀

Mayning doimo bugungidek yuqori texnologiyali harakat bo'lmagan. Bitkoinning dastlabki kunlarida siz standart kompyuterning Markaziy Protsessor Qurilmasi (CPU) yordamida samarali mayning qilishingiz mumkin edi. Bu so'zma-so'z har qanday kompyuter (PC) egasi qila oladigan narsa edi!

- CPU Mayning (Erta Davrlar): Sekin, samarasiz va endilikda asosiy kriptovalyutalar uchun asosan eskirgan.

- GPU Mayning (Grafika Kartalarining Yuksalishi): Qiyinchilik oshgani sayin, maynerlar Grafika Protsessor Qurilmalari (GPU – o'yin kompyuterlaridagi kuchli chiplar) ancha samaraliroq ekanligini angladilar. Bu, ayniqsa, altkoinlar (muqobil kriptovalyutalar) uchun GPU mayningida keskin o'sishga olib keldi. Ko'pchilik bugungi kunda ham ma'lum koinlar uchun GPUlardan foydalanadi!

- FPGA Mayning (Qisqa Oraliq): Field-Programmable Gate Arrays (FPGA) samaradorlik nuqtai nazaridan GPU va ASIC o'rtasida o'rtacha yo'lni taklif qildi, ammo ularning murakkabligi keng tarqalishini chekladi.

- ASIC Mayning (Application-Specific Integrated Circuits) (Kriptoning Sanoat Inqilobi): Application-Specific Integrated Circuits (ASIC) – bu faqat ma'lum bir kriptovalyuta algoritmini (Bitcoin uchun SHA-256 kabi) mayning qilish uchun mo'ljallangan maxsus uskuna. Ular nihoyatda kuchli va samarali, ammo qimmat va shovqinli hamdir. ASIClar bugungi kunda Bitcoin va boshqa ko'plab yirik koinlarni mayning qilish operatsiyalarida ustunlik qiladi.

- Proof-of-Stake (PoS) – Boshqa Paradigma: Barcha kriptovalyutalar an'anaviy ma'noda "mayning" dan foydalanmasligini ta'kidlash juda muhim. Masalan, Ethereum asosan Proof-of-Work (PoW) konsensus mexanizmidan (bu mayningni talab qiladi) Proof-of-Stake (PoS) ga o'tdi. PoS da, hisoblash quvvati bilan jumboqlarni yechish o'rniga, validatorlar tranzaksiyalarni tasdiqlash va yangi bloklarni yaratish uchun mavjud kriptolarini garov sifatida "stek" (stake) qiladilar, evaziga mukofot oladilar. Bu odatda energiyani tejashda samaraliroq. Biz ushbu qo'llanmada PoW mayningga e'tibor qaratamiz, lekin PoS kripto landshaftining muhim qismi ekanligini unutmang!

Nima Uchun 2025 Yilda Mayning Qilish Kerak? Bu Hali Ham Foydalimi? 🤔💸

Bu million dollarlik savol! Mayningning rentabelligi yillar davomida keskin o'zgarib turdi. 2025 yilda bu, albatta, oddiy kompyuterni ulash va kriptoning kelishini tomosha qilish kabi sodda emas. Rentabellikka ta'sir qiluvchi omillarga quyidagilar kiradi:

- Kriptovalyuta Narxi: Siz mayning qilayotgan koinning bozor qiymati qanchalik yuqori bo'lsa, sizning mukofotlaringiz shunchalik qimmatli bo'ladi.

- Mayning Qiyinligi: Tarmoqqa ko'proq maynerlar qo'shilishi bilan, jumboqlarning qiyinligi oshadi, bu esa mukofotlarni qo'lga kiritishni qiyinlashtiradi.

- Uskuna (Hardware) Xarajatlari: ASIC yoki GPU (Grafik Protsessor Birliklari) ga dastlabki sarmoya sezilarli bo'lishi mumkin.

- Elektr Energiya Xarajatlari: Mayning juda ko'p quvvat sarflaydi. Bu ko'pincha eng katta doimiy xarajatdir.

- Uskunangizning Samadorligi: Yangiroq, samaraliroq uskuna (hardware) bir xil hisoblash natijasi uchun kamroq quvvat sarflaydi.

- Pool To'lovlari: Agar siz mayning pool ga qo'shilsangiz (va ehtimol qo'shilasiz), ular sizning daromadingizning kichik foizini oladi.

Yagona ASIC bilan Bitcoin uchun individual hobbi mayningni yuqori elektr xarajati bo'lgan hududlarda doimiy foydali qilish qiyin bo'lishi mumkin bo'lsa-da, imkoniyatlar hali ham mavjud:

- Altcoin Mayningi (GPU): Ko'pgina kichik, yangi kriptovalyutalar hali ham PoW (Ishni Tasdiqlash) dan foydalanadi va GPU (Grafik Protsessor Birliklari) yordamida foydali mayning qilinishi mumkin. Bular ko'pincha past qiyinchilikka va kam raqobatga ega.

- Geografik Afzallik: Agar siz juda arzon elektr energiyasiga kirish imkoniga ega bo'lsangiz (masalan, qayta tiklanadigan manbalar, maxsus sanoat zonalari), sizning rentabelligingiz sezilarli darajada oshadi.

- Uzoq Muddatli HODLing: Ba'zi maynerlar darhol fiat foydasiga kamroq e'tibor berishadi va kelajakdagi narxning potentsial o'sishi uchun kriptoni yig'ishga ko'proq e'tibor berishadi.

The key takeaway: Don’t go into mining blindly! Do your research and calculate potential profitability meticulously before investing.

Boshlash: 2025 yil uchun Mayning Nazorat Ro'yxatingiz 📋

Mayning sayohatingizni boshlashga tayyormisiz? Sizga quyidagilar kerak bo'ladi:

1. Kriptovalyuta va Algoritmingizni Tanlang 🎯

Avvalambor, nimani mayning qilmoqchi ekanligingizni hal qiling. Bu sizning uskunangizni belgilaydi.

- Bitcoin (BTC): SHA-256 algoritmidan foydalanadi. Qimmat, ixtisoslashgan ASIC maynerlar talab qiladi.

- Litecoin (LTC), Dogecoin (DOGE): Scrypt algoritmidan foydalanadi. ASIC yoki kuchli GPU yordamida mayning qilinishi mumkin (garchi ushbu muayyan tangalar uchun ASIClar ustunroq bo'lsa ham).

- Ethereum Classic (ETC) va boshqa PoW Altcoin-lar: Ko'pchiligi Ethash (yoki uning variantlari) kabi algoritmlardan foydalanadi. Asosan GPU (Grafik Protsessor Birliklari) yordamida mayning qilinadi. Bu, ko'pincha yangi maynerlar uchun boshlang'ich nuqta hisoblanadi.

- Monero (XMR): CPUga (Markaziy Protsessor Birligi) ko'proq mos keladigan qilib yaratilgan RandomX algoritmidan foydalanadi, garchi GPUlar (Grafik Protsessor Birliklari) ham samarali ishlatilishi mumkin.

Ehtiyotkorlik bilan o'rganing! Quyidagi omillarga e'tibor bering:

- Bozor Kapitallashuvi; Narx Tarixi: Tanga barqarormi? O'sish salohiyatiga egami?

- Mayning Qiyinchiligi; Hash Rate (Xesh Tezligi): Tarmoq qanchalik raqobatbardosh?

- Algoritm: Qanday uskunani talab qiladi?

- Jamiyat; Rivojlanish: Loyiha faol ravishda qo'llab-quvvatlanadimi?

2. To'g'ri Uskunani Sotib Oling 💻

Bu sizning eng katta dastlabki investitsiyangiz.

A. ASIC Mayning uchun (Bitcoin, Litecoin, va h.k.):

Sizga ASIC mayner kerak bo'ladi. Bular kuchli, maxsus qurilgan mashinalar.

Mulohazalar:

- Hash Rate: Maynerning xom quvvati (masalan, soniyasiga Teraxesh – TH/s). Qanchalik yuqori bo'lsa, shuncha yaxshi.

- Quvvat Samaradorligi: Bir Teraxeshga qancha Joul (J/TH) yoki THga qancha Vatt sarflaydi. Kamroq bo'lsa, yaxshi. Bu sizning elektr energiyasi to'lovingizga bevosita ta'sir qiladi.

- Narx: ASIClar bir necha yuzdan bir necha ming dollargacha turishi mumkin.

- Shovqin va Issiqlik: ASIClar nihoyatda shovqinli va juda ko'p issiqlik chiqaradi. Ular maxsus shamollatish va shovqindan ajratilgan joyga muhtoj.

B. GPU Mayning uchun (Ethereum Classic, boshqa PoW Altcoinlar):

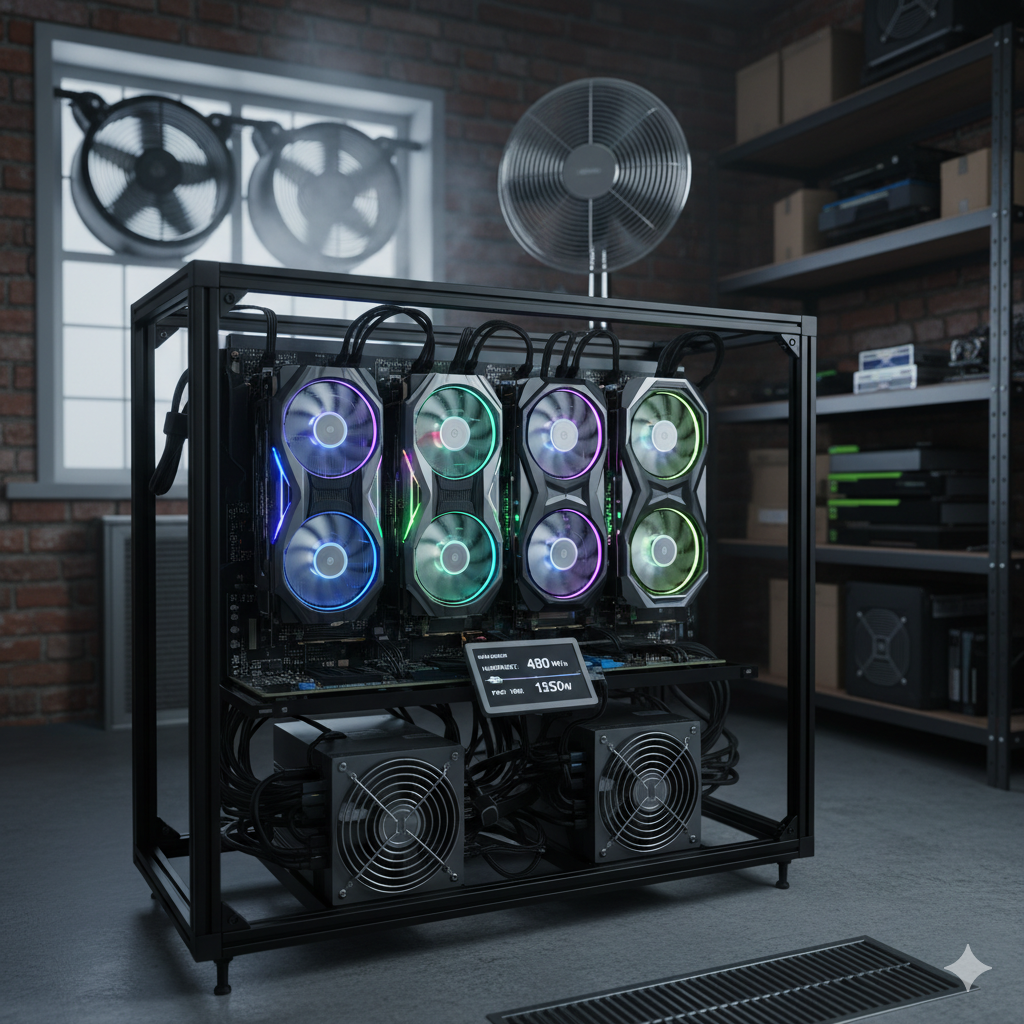

Siz "mayning rig" qurasiz – bu, asosan, bir nechta kuchli grafik kartalariga ega bo'lgan ixtisoslashtirilgan kompyuter.

Komponentlar:

- Bir nechta GPU: Rig'ingizning yuragi. O'rta va yuqori darajadagi AMD Radeon yoki NVIDIA GeForce kartalarini tanlang (masalan, RX 6000 seriyasi, RTX 30 seriyasi yoki yangiroq).

- Anaplata: Barcha GPU-laringizni joylashtirish uchun yetarli PCIe uyalari bo'lishi kerak.

- CPU (Markaziy Protsessor Qurilmasi): Odatda oddiy, arzon CPU (Markaziy Protsessor Qurilmasi) etarli bo'ladi.

- RAM: 8 GB – 16 GB odatda yetarli.

- Storage (SSD): Operatsion tizimingiz va mayning dasturiy ta'minotingiz uchun kichik SSD (120-250 GB).

- Quvvat Ta'minoti Bloklari: Hal qiluvchi! O'sha och GPU larni ta'minlash uchun sizga kuchli, ishonchli quvvat ta'minoti bloklari (PSU) kerak bo'ladi. Ko'pincha, bir nechta PSU ishlatiladi.

- Ochiq Havo Mining Ramkasi: Barcha komponentlaringizni o'rnatish, yaxshi havo oqimini ta'minlash va qurilmalarni salqin saqlash uchun.

- PCIe Risers: GPU-larni anaplataga ulaydigan kabellar, yaxshiroq joylashtirish imkonini beradi.

- Operating System: Ko'pincha mayning uchun maxsus mo'ljallangan HiveOS yoki RaveOS kabi engil vaznli Linux asosidagi OS.

3. Kripto Hamyonni Xavfsiz Qiling 🔒

Mayningni boshlashdan oldin, sizga topilgan koinlaringizni saqlash uchun xavfsiz joy kerak. Kriptovalyuta hamyoni muhim ahamiyatga ega.

- Dasturiy Hamyonlar (Hot Wallets): Kompyuteringizdagi yoki telefoningizdagi ilovalar. Qulay, ammo ular internetga ulanganligi sababli odatda kamroq xavfsiz.

- Apparat Hamyonlari (Hardware Wallets) (Sovuq Hamyonlar): Shaxsiy kalitlaringizni offline saqlaydigan jismoniy qurilmalar (USB fleshka kabi). Juda xavfsiz, katta miqdordagi kripto uchun tavsiya etiladi. Misollar: Ledger, Trezor.

Har doim seed phrase (so'zlar ro'yxati) zaxira nusxasini yarating va uni offline rejimida juda xavfsiz saqlang. Bu sizning kriptoingizga kalit!

4. Mining Pool-ga Qo'shiling 🏊♂️

Agar sizda ulkan mayning operatsiyasi bo'lmasa, asosiy kriptovalyutalar uchun solo mayning qilish bir chipta bilan lotereyada yutishga urinishga o'xshaydi. Blokni o'zingiz hal qilish imkoniyatingiz juda oz.

Bu yerda mining pool-lar ishga tushadi. Mining pool – bu block-ni yechish imkoniyatini oshirish uchun o‘zlarining hisoblash quvvatlarini birlashtirgan miner-lar guruhidir. Pool block-ni muvaffaqiyatli mayning qilganda, mukofot barcha ishtirokchilarga ular qo'shgan hashing quvvati miqdoriga mutanosib ravishda taqsimlanadi.

Ommabop Mining Pool-lar (o'zingizning maxsus koiningiz uchun tekshiring):

- F2Pool

- ViaBTC

- AntPool

- NiceHash (bir oz boshqacha, hash power-ni ijaraga beradi/sotib oladi)

Pool tanlashda e'tiborga olish kerak bo'lgan jihatlar:

- Pool To'lovlari: Odatda 1-4%.

- To'lov Chegaralari (Payout Thresholds): Mablag'lar wallet-ingizga o'tkazilishidan oldin siz olishingiz kerak bo'lgan minimal miqdor.

- To'lov Sxemasi (Payment Scheme): Mukofotlar qanday taqsimlanadi (masalan, PPS, PPLNS).

- Obro' va Ishonchlilik (Reputation & Reliability): Yaxshi tashkil etilgan pool tanlang.

5. Mining Dasturini O'rnating ⚙️

Uskunangizni olib, pool-ga qo'shilganingizdan so'ng, bularning barchasini ishga tushirish uchun dasturiy ta'minot kerak bo'ladi.

- ASIC uchun: Ko'pincha oldindan o'rnatilgan firmware bilan keladi. Siz odatda uni pool ma'lumotlaringiz bilan sozlash uchun veb-interfeysga kirasiz.

- GPU Riglari uchun: Siz mining operatsion tizimini (HiveOS, RaveOS, yoki hatto maxsus dasturiy ta'minot bilan Windows kabi) o'rnatasiz va keyin mining mijozini o'rnatasiz. Mashhur GPU mining mijozlari quyidagilarni o'z ichiga oladi:

- T-Rex Miner

- GMiner

- LolMiner

- NBminer

Ushbu mijozlar siz tanlagan pool manzili, wallet manzilingiz (ko'pincha pooldagi "foydalanuvchi nomi" sifatida) va parol (ko'pincha "x" yoki ishchi nomi) bilan sozlanadi.

6. Yoqing va Nazorat Qiling! ⚡️📊

Hamma narsa sozlangandan so'ng:

- Quvvat va Internetga Ulang: Sozlamangiz barqaror ekanligiga ishonch hosil qiling.

- Mining Dasturini Ishga Tushiring: Mining Jarayonini Boshlang.

- Rigni Kuzating: Eng muhimi, quyidagilarni kuzatib boring:

- Haroratlar: Juda issiq ishlaydigan GPU / ASIClar ish faoliyatini pasaytiradi va xizmat muddatini qisqartiradi. Yetarli sovutishni ta'minlang!

- Hash Rate: Sizning haqiqiy mining quvvatingiz.

- Energiya Sarfi: Haqiqiy iste'molni ko'rish uchun kill-a-watt o'lchagichidan foydalaning.

- Rad Etishlar / Xatolar: Yuqori rad etish darajasi nimadir noto'g'ri ekanligini bildiradi.

- Daromadlar: Aksariyat poollar real vaqtdagi daromadlaringizni kuzatish uchun dashboard taqdim etadi.

Mining doimiy jarayondir. Optimal ishlash va samaradorlik uchun jihozlaringizni muntazam tekshirib turishingiz, dasturiy ta'minotni yangilashingiz va potensial ravishda sozlamalarni o'zgartirishingiz kerak bo'ladi.

2025 Yilgi Minerlar Uchun Muhim E'tiborlar 🙏

- Elektr Quvvati Xarajatlari: Jiddiy aytganda, bu yetarlicha ta'kidlanishi mumkin emas. Yuqori elektr energiyasi narxlari foydali operatsiyani tezda pul yutqazish manbaiga aylantirishi mumkin. Mahalliy tariflaringizni o'rganing!

- Shovqin va Issiqlik: Mining uskunalari sezilarli darajada issiqlik va shovqin chiqaradi. Bu sizning yotoqxonangizda bo'lishni xohlaydigan narsa emas. To'g'ri shamollatish va ajratilgan joy muhim ahamiyatga ega.

- Internet Aloqasi: Barqaror, ishonchli internet aloqasi hayotiy ahamiyatga ega.

- Texnik Xizmat Ko'rsatish: Chang to'planishi, ventilyator nosozliklari va umumiy eskirish odatiy holdir. Muntazam texnik xizmat ko'rsatishga tayyor bo'ling.

- Bozor O'zgaruvchanligi: Kriptovalyuta narxlari juda o'zgaruvchan. Bugun foydali bo'lgan narsa ertaga bo'lmasligi mumkin. Uzoq muddatli istiqbolga ega bo'ling.

- Qoidalar: Kriptovalyuta qoidalari doimiy ravishda rivojlanib bormoqda. Mining va kriptovalyuta daromadlariga oid hududingizdagi qonunlar haqida xabardor bo'ling.

- Atrof-muhitga Ta'siri: Mining (ayniqsa, PoW) sezilarli darajada energiya iste'mol qiladi. Agar iloji bo'lsa, uglerod izini kamaytirish uchun qayta tiklanadigan energiya manbalaridan foydalanishni ko'rib chiqing. 🌍

- Firibgarliklar: Firibgarlik loyihalaridan, cloud mining firibgarliklaridan va shubhali uskuna sotuvchilardan ehtiyot bo'ling. O'z tekshiruvlaringizni amalga oshiring!

Bulutli Mayning variantmi? ☁️

Bulutli mayning kompaniyaga ularning ma'lumotlar markazlaridan hesh quvvatini ijaraga olish uchun pul to'lashni o'z ichiga oladi. Siz uskunaga egalik qilmaysiz; siz shunchaki to'lov qilasiz va qazib olingan kriptovalyutaning ulushini olasiz.

Afzalliklari: Boshlang'ich uskunalar xarajati yo'q, shovqin/issiqlik/parvarishlash yo'q, elektr energiyasi bilan bog'liq xavotirlar kamayishi mumkin.

Kamchiliklari: Firibgarlik xavfi yuqori, past rentabellik (to'lovlar tufayli), kamroq nazorat, siz cloud mining kompaniyasining samaradorligi va halolligiga bog'liqsiz.

2025 yilda, ba'zi qonuniy bulutli mayning operatsiyalari mavjud bo'lsa-da, bu soha hali ham firibgarliklar bilan to'la. Agar siz ushbu variantni ko'rib chiqsangiz, o'ta ehtiyotkorlik va chuqur tadqiqot bilan harakat qiling. Ko'pchilik buni yangi boshlanuvchilar uchun tavsiya qilmaydi.

Mayningning Kelajagi: 2025 Va PoS Dan Keyin 🔮

Ko'plab kriptovalyutalar uchun Ishni isbotlash (Proof-of-Work) mayningi davom etsa-da, energiya iste'moli va markazsizlashtirish bilan bog'liq xavotirlar tufayli Ulushni isbotlash (Proof-of-Stake) va boshqa konsensus mexanizmlariga bo'lgan tendentsiya inkor etilmaydi. Ethereumning PoSga muvaffaqiyatli birlashishi muhim voqea bo'ldi.

Biroq, PoW butunlay yo'qolmaydi. Eng yirik kriptovalyuta Bitcoin qat'iy PoW bo'lib qoladi. Boshqa ko'plab rivojlanayotgan loyihalar ham o'zining sezilgan xavfsizligi va soddaligi uchun PoWni tanlaydi. Shuning uchun, PoW mayningini tushunish kripto dunyosida qimmatli ko'nikma bo'lib qoladi.

Xulosa: Sizning Raqamli Oltin Shoshqalog'ingiz Kutmoqda! ✨

2025 yilda kriptovalyuta mayningi murakkab, ammo potentsial ravishda foydali ishdir. Bu ehtiyotkorlik bilan rejalashtirishni, sezilarli dastlabki sarmoyani va doimiy monitoringni talab qiladi. Bu tez boyib ketish sxemasi emas, balki raqamli aktivlarni potentsial ravishda qo'lga kiritish bilan birga markazlashtirilmagan tarmoqqa hissa qo'shish majburiyatidir.

Apparatlar, dasturiy ta'minot, iqtisodiy omillar va xavflarni tushunish orqali siz asosli qarorlar qabul qilishingiz va kripto mayningning jozibador dunyosiga o'z sayohatingizni boshlashingiz mumkin. Omad yor bo'lsin, raqamli qidiruvchi – hash rate-ingiz yuqori va elektr energiyasi uchun to'lovlar past bo'lsin! Baxtli mayning! ⛏️💰🚀