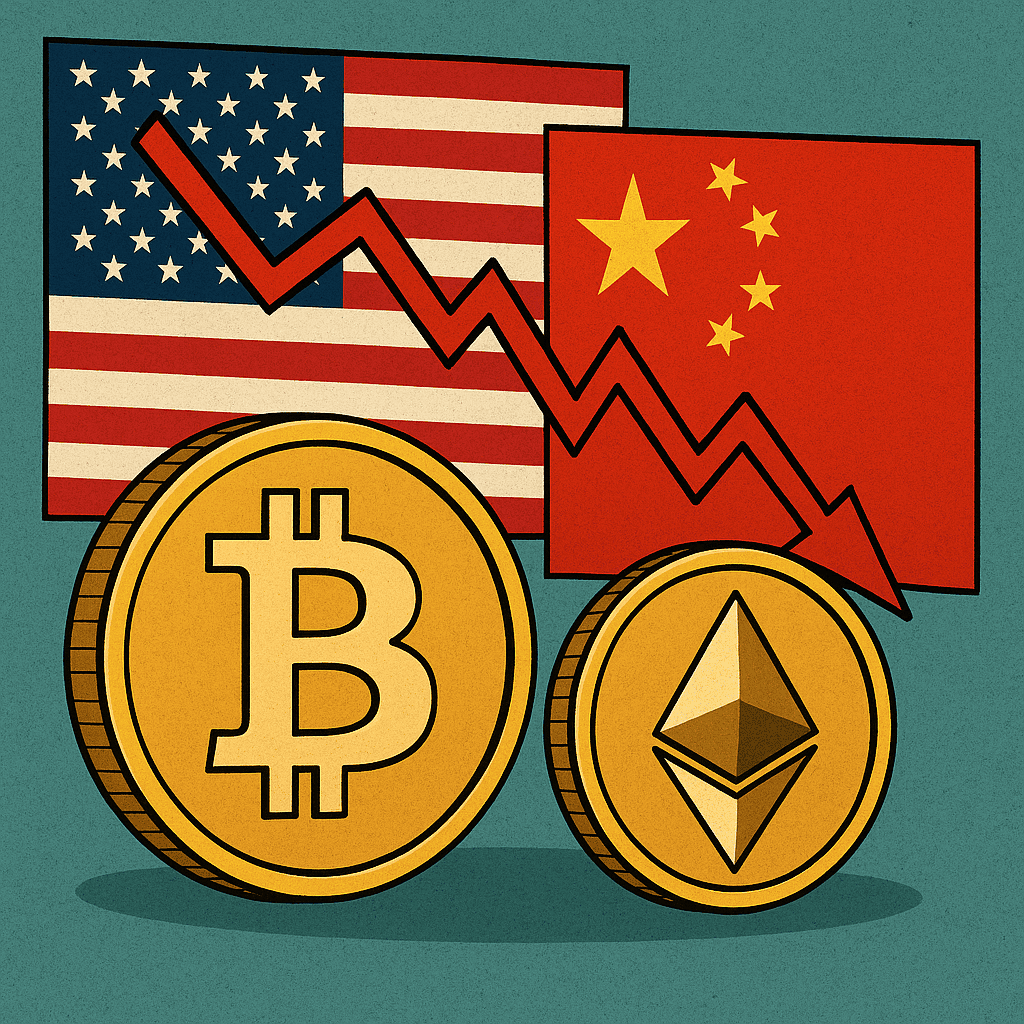

On October 14, 2025, Bitcoin and Ether fell sharply as renewed trade tensions between the United States and China sparked investor risk aversion. Bitcoin dipped as low as $110,023.78 before partially recovering to about $113,129—a decline of roughly 2.3% for the day. Meanwhile, Ether tumbled to a low of $3,900.80 and closed at $4,128.47, down about 3.7%. Altcoins bore the brunt of broader volatility, with some seeing double-digit losses on certain exchanges.

The sell-off followed new port fees imposed by both nations on maritime shipping firms, a move seen as an escalation in the ongoing trade war. Analysts point to the fragility of crypto relative to macro and geopolitical shocks: when risk sentiment sours, digital assets are often among the first to be cast aside. Liquidations from leveraged positions—especially in volatile altcoins—amplified losses, further pushing the decline.

Looking ahead, crypto markets face a delicate balance. If tensions escalate further, additional downside remains possible. But if governments step back from brinkmanship, a rebound might be on the cards—especially if inflows renew into Bitcoin. For now, traders and investors will be watching global trade developments, regulatory moves, and macro sentiment for cues on whether this correction deepens or reverses.