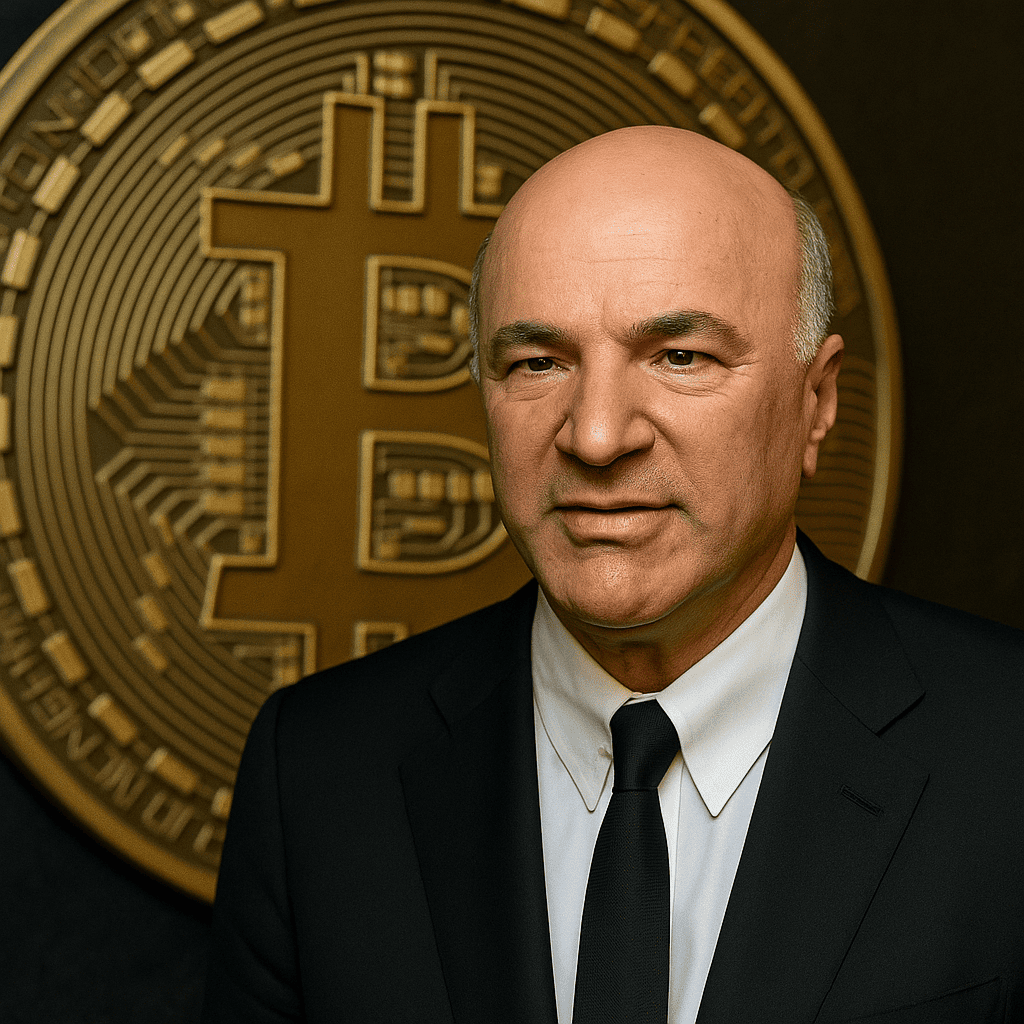

Kevin O’Leary—best known to many as the sharp-tongued investor on Shark Tank —has quietly made a strong play into Bitcoin mining. Rather than just buying Bitcoin or backing crypto startups, O’Leary is positioning himself deeper in the value chain: in the power, equipment, and infrastructure that make mining possible. His move is no whim; it reflects a belief that the real long-term value in crypto lies not just in the coins, but in the means to produce them.

O’Leary’s shift follows trends we’ve seen ramping up in 2025. Mining is increasingly viewed not merely as speculation on Bitcoin prices, but as a strategic energy and compute business. Infrastructure—renewable power, grid contracting, cooling systems, ASIC deployment—is where high barriers to entry reside. By placing capital there, O’Leary is aiming for durability rather than short-term gains. His bets may include partnerships with mining operators, hosting deals, or direct investment in mining companies with strong balance sheets and operational discipline.

That said, even O’Leary’s confidence doesn’t erase the risks. Energy costs remain volatile, regulations could tighten (especially around power consumption and crypto taxes), and mining difficulty continues its upward march. Execution matters: the best hardware, most favorable contracts, and strongest teams will separate winners from losers. But with his brand, capital, and networks behind him, O’Leary is signaling that he sees Bitcoin mining as a foundational layer of the crypto economy—not an accessory.