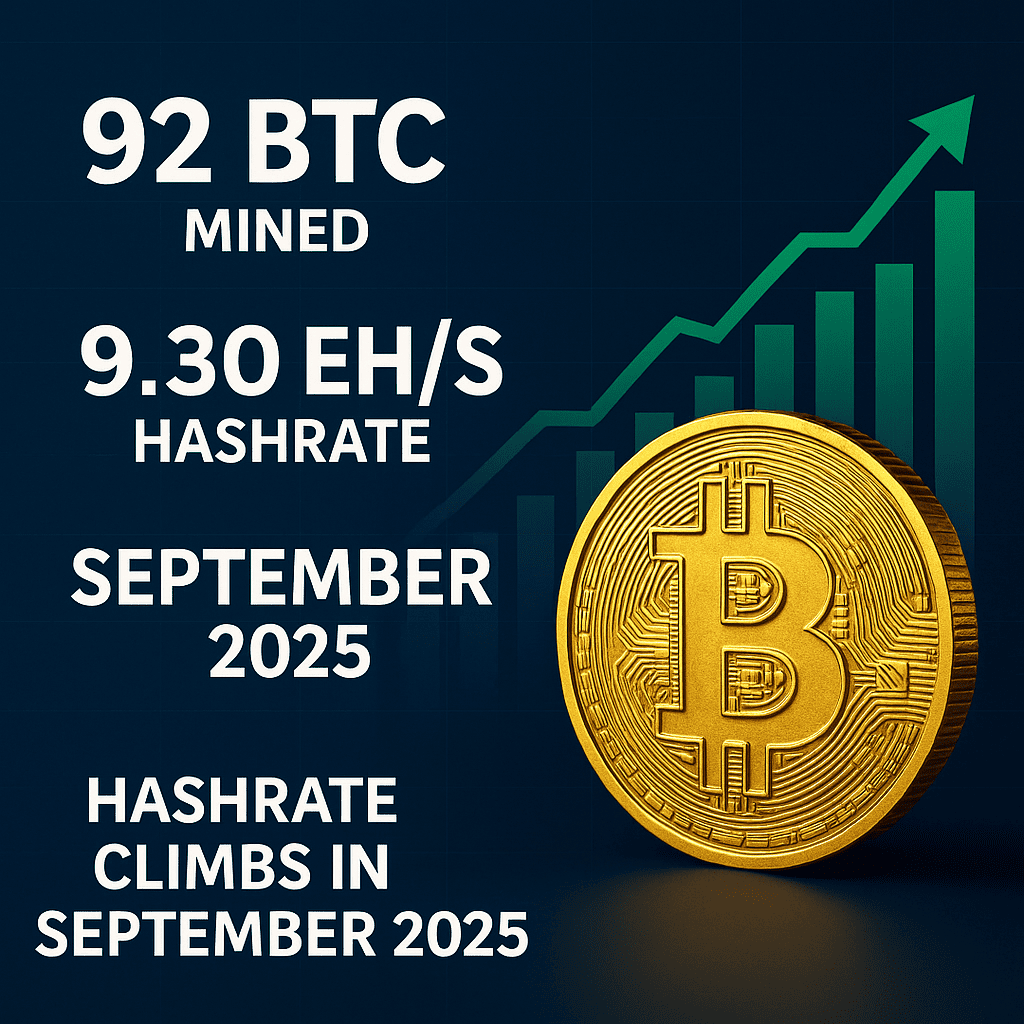

In September 2025, Canaan Inc. reported a milestone: its deployed hashrate reached a historic high of 9.30 EH/s, with an operating hashrate of 7.84 EH/s. Over that month, the company mined 92 bitcoins, pushing its crypto treasury to a record 1,582 BTC (alongside 2,830 ETH holdings). These figures reflect a company that is increasingly leveraging scale, operational upgrades, and balance sheet strength to stake its claim among major miners.

Canaan also spotlighted key metrics that underpin its performance. The company recorded an average all-in power cost of about $0.042 per kWh, while efficiency in North American operations improved to 19.7 J/TH—a competitive result given rising electricity pressures across the industry. Moreover, Canaan secured a landmark purchase order for over 50,000 Avalon A15 Pro miners, its largest deal in three years, and announced a 20 MW renewable partnership with Soluna for deployment starting in Q1 2026.

While these developments are promising, challenges remain. There is a gap between deployed and active hashrate—meaning some capacity is not yet energized. Execution will be critical as Canaan must roll out those machines efficiently, manage energy costs, and maintain uptime. If it succeeds, the company could strengthen its position not just as a hardware vendor (ASIC producer) but also as a serious player in self-mining and crypto infrastructure.