Welcome, future digital prospector! Ever wondered how those shiny cryptocurrencies like Bitcoin and Ethereum come into existence? It’s not magic, it’s “mining” – a fascinating process that’s part technology, part economics, and entirely essential to the decentralized world of crypto. If you’re looking to dip your toes into this exciting arena in 2025, you’ve come to the right place. This comprehensive, beginner-friendly guide will demystify cryptocurrency mining, giving you a solid foundation to start your own digital gold rush. So, grab your virtual pickaxe, and let’s dig in!

What Exactly Is Cryptocurrency Mining? 🤔

At its core, cryptocurrency mining is the process by which new cryptocurrency units are created and transactions are verified and added to the blockchain. Think of the blockchain as a massive, public, unchangeable digital ledger. Every time someone sends crypto to another person, that transaction needs to be recorded and confirmed. That’s where miners come in!

Miners use powerful computers to solve complex computational puzzles. The first miner to solve the puzzle gets to add a new “block” of verified transactions to the blockchain and, as a reward, receives newly minted cryptocurrency and often transaction fees. It’s a race against other miners, a digital competition for those valuable rewards.

This process serves two crucial functions:

- Creation of New Currency: It’s how new coins enter circulation (e.g., new Bitcoins are “mined”).

- Transaction Verification ; Network Security: It validates transactions, prevents double-spending, and secures the entire decentralized network against fraud and attacks. Without miners, the blockchain wouldn’t function!

The Evolution of Mining: From CPUs to ASICs (and Beyond!) 🚀

Mining hasn’t always been the high-tech endeavor it is today. In the early days of Bitcoin, you could mine effectively with a standard computer’s Central Processing Unit (CPU). It was literally something anyone with a PC could do!

- CPU Mining (Early Days): Slow, inefficient, and now largely obsolete for major cryptocurrencies.

- GPU Mining (The Rise of Graphics Cards): As difficulty increased, miners realized Graphics Processing Units (GPUs – the powerful chips in gaming computers) were far more efficient. This led to a boom in GPU mining, especially for altcoins (alternative cryptocurrencies). Many still use GPUs today for certain coins!

- FPGA Mining (A Brief Interlude): Field-Programmable Gate Arrays offered a middle ground between GPUs and ASICs in terms of efficiency, but their complexity limited widespread adoption.

- ASIC Mining (The Industrial Revolution of Crypto): Application-Specific Integrated Circuits are specialized hardware designed only to mine a specific cryptocurrency algorithm (like SHA-256 for Bitcoin). These are incredibly powerful and efficient but also expensive and noisy. ASICs dominate Bitcoin and many other major coin mining operations today.

- Proof-of-Stake (PoS) – A Different Paradigm: It’s crucial to mention that not all cryptocurrencies use “mining” in the traditional sense. Ethereum, for example, has largely transitioned from a Proof-of-Work (PoW) consensus mechanism (which requires mining) to Proof-of-Stake (PoS). In PoS, instead of solving puzzles with computational power, validators “stake” their existing crypto as collateral to verify transactions and create new blocks, earning rewards in return. This is generally more energy-efficient. We’ll focus on PoW mining for this guide, but remember that PoS is a significant part of the crypto landscape!

Why Mine in 2025? Is It Still Profitable? 🤔💸

This is the million-dollar question! The profitability of mining has fluctuated wildly over the years. In 2025, it’s certainly not as simple as plugging in a basic computer and watching the crypto roll in. Factors influencing profitability include:

- Cryptocurrency Price: The higher the market value of the coin you’re mining, the more valuable your rewards.

- Mining Difficulty: As more miners join the network, the difficulty of the puzzles increases, making it harder to earn rewards.

- Hardware Costs: The initial investment in ASICs or GPUs can be substantial.

- Electricity Costs: Mining consumes a lot of power. This is often the biggest ongoing expense.

- Efficiency of Your Hardware: Newer, more efficient hardware consumes less power for the same computational output.

- Pool Fees: If you join a mining pool (and you likely will), they take a small percentage of your earnings.

While individual hobby mining for Bitcoin with a single ASIC might be challenging to make consistently profitable in high-electricity cost regions, there are still opportunities:

- Altcoin Mining (GPU): Many smaller, newer cryptocurrencies still use PoW and can be profitably mined with GPUs. These often have lower difficulty and less competition.

- Geographic Advantage: If you have access to very cheap electricity (e.g., renewable sources, specific industrial zones), your profitability significantly increases.

- Long-Term HODLing: Some miners are less concerned with immediate fiat profit and more with accumulating crypto for potential future value appreciation.

The key takeaway: Don’t go into mining blindly! Do your research and calculate potential profitability meticulously before investing.

Getting Started: Your Mining Checklist for 2025 📋

Ready to start your mining journey? Here’s what you’ll need:

1. Choose Your Cryptocurrency & Algorithm 🎯

First, decide what you want to mine. This will dictate your hardware.

- Bitcoin (BTC): Uses the SHA-256 algorithm. Requires expensive, specialized ASIC miners.

- Litecoin (LTC), Dogecoin (DOGE): Use the Scrypt algorithm. Can be mined with ASICs or powerful GPUs (though ASICs are more dominant for these specific coins).

- Ethereum Classic (ETC) and other PoW Altcoins: Many use algorithms like Ethash (or variations thereof). Primarily mined with GPUs. This is often the starting point for new miners.

- Monero (XMR): Uses the RandomX algorithm, designed to be more CPU-friendly, though GPUs can also be used effectively.

Research carefully! Look at factors like:

- Market Cap ; Price History: Is the coin stable? Does it have growth potential?

- Mining Difficulty; Hash Rate: How competitive is the network?

- Algorithm: What hardware does it require?

- Community ; Development: Is the project actively maintained?

2. Acquire the Right Hardware 💻

This is your biggest upfront investment.

A. For ASIC Mining (Bitcoin, Litecoin, etc.):

You’ll need an ASIC miner. These are powerful, purpose-built machines.

Considerations:

- Hash Rate: The raw power of the miner (e.g., Terahashes per second – TH/s). Higher is better.

- Power Efficiency: How many Joules per Terahash (J/TH) or Watts per TH it consumes. Lower is better. This directly impacts your electricity bill.

- Price: ASICs can range from a few hundred to several thousand dollars.

- Noise & Heat: ASICs are incredibly loud and generate immense heat. They need dedicated ventilation and a noise-isolated space.

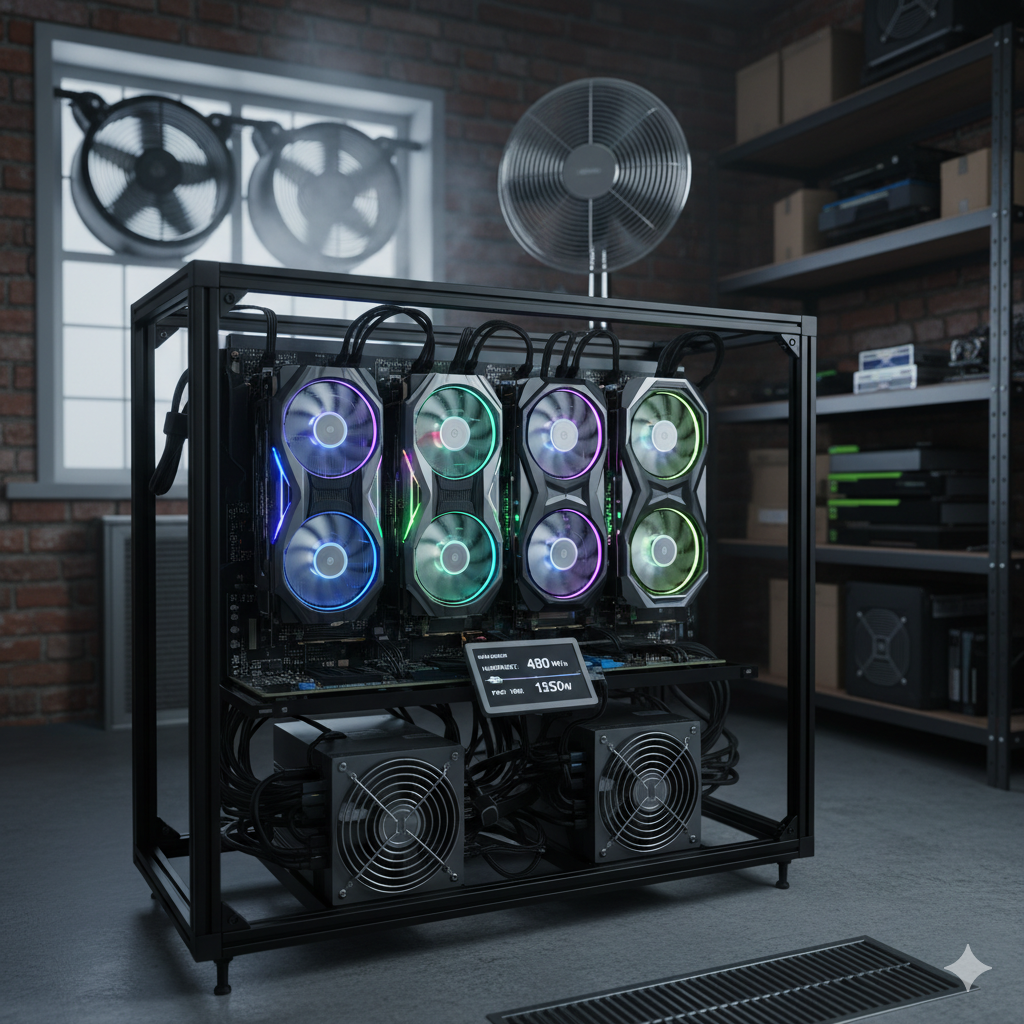

B. For GPU Mining (Ethereum Classic, other PoW Altcoins):

You’ll build a “mining rig” – essentially a specialized computer with multiple powerful graphics cards.

Components:

- Multiple GPUs: The heart of your rig. Aim for mid-to-high-end AMD Radeon or NVIDIA GeForce cards (e.g., RX 6000 series, RTX 30 series, or newer).

- Motherboard: Must have enough PCIe slots to accommodate all your GPUs.

- CPU: A basic, inexpensive CPU is usually sufficient.

- RAM: 8GB-16GB is typically enough.

- Storage (SSD): A small SSD (120-250GB) for your operating system and mining software.

- Power Supply Units (PSUs): Crucial! You’ll need powerful, reliable PSUs to feed all those hungry GPUs. Often, multiple PSUs are used.

- Open Air Mining Frame: To mount all your components, allow for good airflow, and keep things cool.

- PCIe Risers: Cables that connect GPUs to the motherboard, allowing for better spacing.

- Operating System: Often a lightweight Linux-based OS like HiveOS or RaveOS, specifically designed for mining.

3. Secure a Crypto Wallet 🔒

Before you start mining, you need a safe place to store your earned coins. A cryptocurrency wallet is essential.

- Software Wallets (Hot Wallets): Apps on your computer or phone. Convenient, but generally less secure as they are connected to the internet.

- Hardware Wallets (Cold Wallets): Physical devices (like a USB stick) that store your private keys offline. Highly secure, recommended for larger amounts of crypto. Examples: Ledger, Trezor.

Always back up your seed phrase (a list of words) and keep it extremely secure offline. This is your key to your crypto!

4. Join a Mining Pool 🏊♂️

Unless you have an enormous mining operation, solo mining for major cryptocurrencies is like trying to win the lottery with one ticket. Your chances of solving a block yourself are incredibly slim.

This is where mining pools come in. A mining pool is a group of miners who combine their computational power to increase their chances of solving a block. When the pool successfully mines a block, the reward is distributed among all participants proportional to the amount of hashing power they contributed.

Popular Mining Pools (check for your specific coin):

- F2Pool

- ViaBTC

- AntPool

- NiceHash (a bit different, rents out/buys hash power)

Considerations when choosing a pool:

- Pool Fees: Typically 1-4%.

- Payout Thresholds: Minimum amount you need to earn before funds are transferred to your wallet.

- Payment Scheme: How rewards are distributed (e.g., PPS, PPLNS).

- Reputation & Reliability: Choose a well-established pool.

5. Install Mining Software ⚙️

Once you have your hardware and have joined a pool, you need software to make it all work.

- For ASICs: Often comes with pre-installed firmware. You’ll typically access a web interface to configure it with your pool details.

- For GPU Rigs: You’ll install a mining operating system (like HiveOS, RaveOS, or even Windows with specific software) and then install a mining client. Popular GPU mining clients include:

- T-Rex Miner

- GMiner

- LolMiner

- NBminer

These clients are configured with your chosen pool’s address, your wallet address (often as your “username” in the pool), and a password (often “x” or a worker name).

6. Power Up and Monitor! ⚡️📊

Once everything is set up:

- Connect to Power and Internet: Make sure your setup is stable.

- Start Mining Software: Initiate the mining process.

- Monitor Your Rig: Crucially, keep an eye on:

- Temperatures: GPUs/ASICs running too hot will throttle performance and shorten lifespan. Ensure adequate cooling!

- Hash Rate: Your actual mining power.

- Power Consumption: Use a kill-a-watt meter to see actual draw.

- Rejects/Errors: High reject rates mean something is wrong.

- Earnings: Most pools provide a dashboard to track your real-time earnings.

Mining is an ongoing process. You’ll need to regularly check on your equipment, update software, and potentially adjust settings for optimal performance and efficiency.

Crucial Considerations for 2025 Miners 🙏

- Electricity Costs: Seriously, this cannot be stressed enough. High electricity prices can quickly turn a profitable operation into a money pit. Research your local rates!

- Heat & Noise: Mining hardware generates substantial heat and noise. This is not something you want in your bedroom. Proper ventilation and a dedicated space are essential.

- Internet Connection: A stable, reliable internet connection is vital.

- Maintenance: Dust accumulation, fan failures, and general wear and tear are common. Be prepared for regular maintenance.

- Market Volatility: Cryptocurrency prices are notoriously volatile. What’s profitable today might not be tomorrow. Have a long-term perspective.

- Regulations: Crypto regulations are constantly evolving. Stay informed about laws in your region regarding mining and cryptocurrency earnings.

- Environmental Impact: Mining (especially PoW) consumes significant energy. Consider using renewable energy sources if possible to reduce your carbon footprint. 🌍

- Scams: Be wary of scam projects, cloud mining scams, and shady hardware sellers. Do your due diligence!

Is Cloud Mining an Option? ☁️

Cloud mining involves paying a company to rent hashing power from their data centers. You don’t own the hardware; you just pay a fee and receive a share of the mined crypto.

Pros: No upfront hardware cost, no noise/heat/maintenance, potentially lower electricity concerns.

Cons: High risk of scams, lower profitability (due to fees), less control, you’re at the mercy of the cloud mining company’s efficiency and honesty.

In 2025, while some legitimate cloud mining operations exist, the space is still rife with scams. Proceed with extreme caution and thorough research if considering this option. Many would advise against it for beginners.

The Future of Mining: Beyond 2025 and PoS 🔮

While Proof-of-Work mining continues for many cryptocurrencies, the trend towards Proof-of-Stake and other consensus mechanisms is undeniable, driven by concerns over energy consumption and decentralization. Ethereum’s successful merge to PoS was a landmark event.

However, PoW isn’t going away entirely. Bitcoin, the largest cryptocurrency, remains steadfastly PoW. Many other emerging projects also choose PoW for its perceived security and simplicity. Therefore, understanding PoW mining remains a valuable skill in the crypto world.

Conclusion: Your Digital Gold Rush Awaits! ✨

Cryptocurrency mining in 2025 is a complex but potentially rewarding endeavor. It requires careful planning, a significant upfront investment, and ongoing monitoring. It’s not a get-rich-quick scheme, but rather a commitment to contributing to a decentralized network while potentially earning digital assets.

By understanding the hardware, software, economic factors, and risks involved, you can make informed decisions and embark on your own journey into the fascinating world of crypto mining. Good luck, digital prospector – may your hash rate be high and your electricity bills low! Happy mining! ⛏️💰🚀