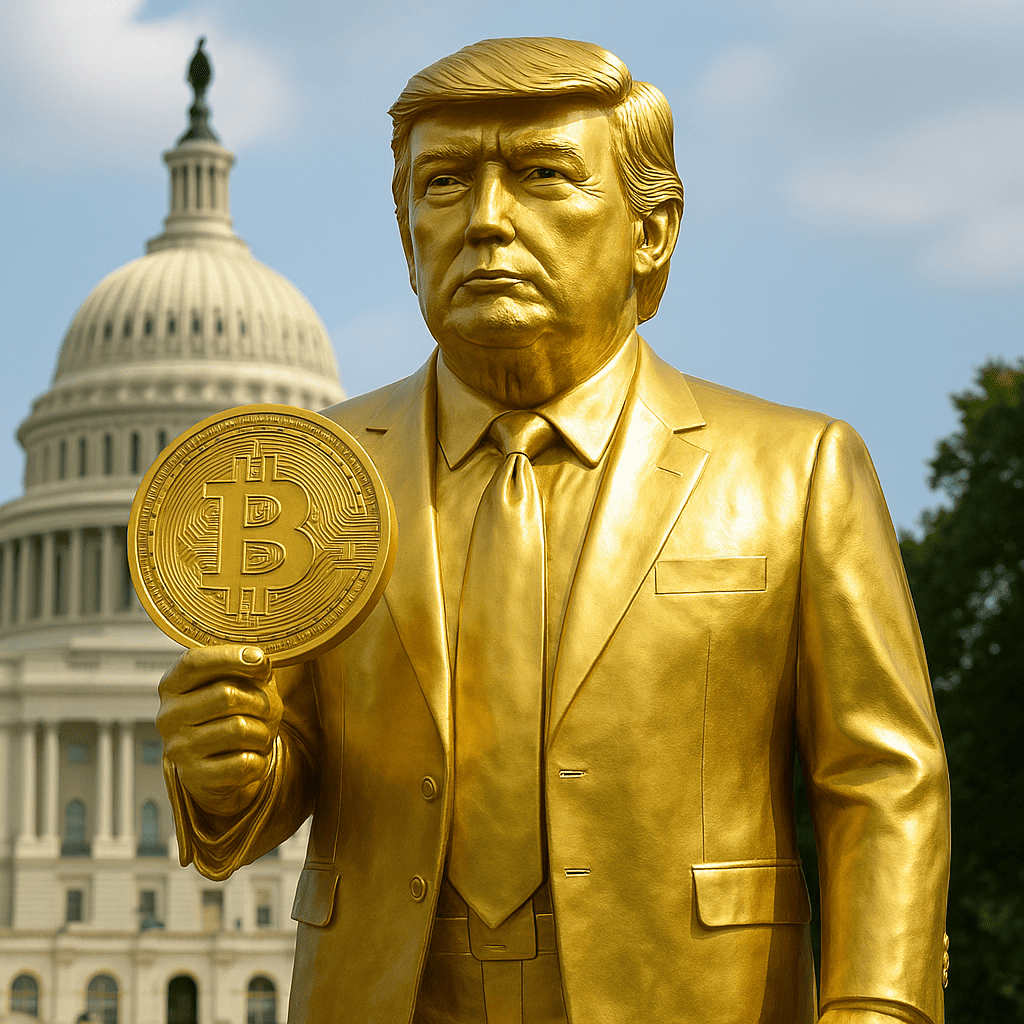

A dramatic 12-foot golden statue of Donald Trump holding a Bitcoin was unveiled outside the U.S. Capitol this week, timed to coincide with a fresh announcement by the Federal Reserve. The Fed’s new rate cut marks its first since late 2024, injecting both relief and uncertainty into markets already jittery from inflation, policy signals, and geopolitical tensions. Observers immediately saw the statue as more than art — it’s a provocation, a political symbol, and a conversation starter about the role of cryptocurrencies, national monetary policy, and the shifting landscape of financial influence.

The installation — temporary, funded by crypto-interested investors — seems designed specifically to force reflection. Is the future of money about centralized control and traditional institutions, or decentralized systems and digital assets? With Bitcoin’s visibility growing, it becomes harder to ignore how central banks, government regulators, and private investors are all jockeying for influence in how currency and value are defined. The statue, holding its digital coin aloft, captures this tension: a statement that coin and code are no longer fringe-ideas, but core players in global economic discourse.

But symbolism alone won’t answer deeper questions. How will policy respond to growing demands for crypto regulation? How might interest rate decisions impact crypto asset stability or adoption? And can Bitcoin fully escape its volatility or regulatory challenges long enough to become a safe haven or a common medium of exchange? For many, the statue isn’t just an image — it’s a bellwether. One thing is clear: as governments and markets evolve, so too will the symbols that represent them.